Secret Factors You Must Need a Prenup Arrangement Prior To Getting In a Marital Relationship Agreement

Understanding the Essentials of a Prenuptial Contract

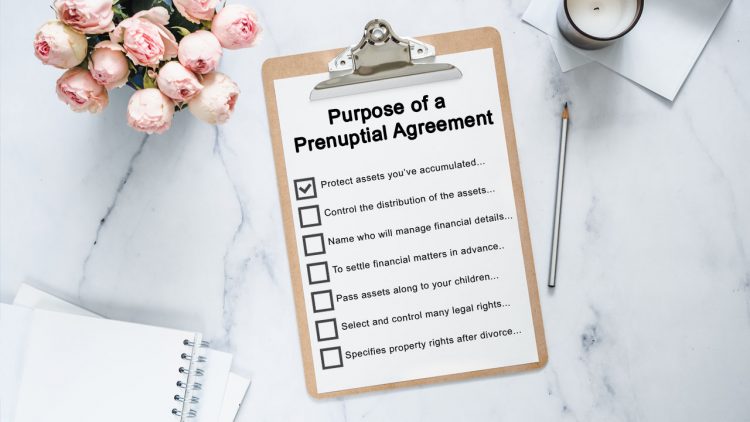

While many view it as unromantic, a prenuptial contract, or 'prenup', works as a sensible tool in the realm of marriage planning. This lawfully binding agreement, frequently structured by spouses-to-be, lays out the division and circulation of possessions and obligations in case of divorce or fatality. It's essential to understand that prenups aren't just for the upscale. Rather, they offer a clear financial roadmap for couples, promoting open interaction about monetary matters and potentially preventing disputes down the line. In spite of its rather downhearted facility, a prenuptial contract can substantially ease the stress and unpredictability that often accompany separation proceedings, using a complacency and control to both parties included.

Safeguarding Private Assets and Financial Obligations

To secure specific assets and financial obligations in a marriage, a prenuptial arrangement shows to be a vital tool. Additionally, a prenuptial arrangement is vital in shielding one from the other's financial obligations. Hence, a prenuptial arrangement offers a safety and security internet, making certain financial implications of a potential break up do not unfairly negative aspect either event.

Security for Local Business Owner

For countless service proprietors, a prenuptial arrangement can be a critical safety step. Also if one partner spent in the company throughout marital relationship, a well-crafted prenup can determine that the company isn't thought about marital residential property. A prenuptial agreement is not just an agreement in between future spouses; it can be seen as an insurance policy for the company.

How Prenups Protect Future Inheritance and Estate Strategies

In the world of future inheritance and estate plans, prenuptial contracts offer as Read More Here a vital safeguard. These contracts can explicitly stipulate that specific possessions, like an inheritance, ought to not be identified as marriage property. Hence, prenuptial contracts play a crucial function in protecting future wide range and making sure a person's monetary security (Flat fee prenuptial agreement).

Ensuring Family Members Possessions and Interests

While prenuptial arrangements are usually watched as a method to safeguard individual wide range, they also serve an important function in making sure household possessions and rate of interests. These arrangements can protect family-owned companies, treasures, or estates from coming to be entangled in a potential divorce settlement. In addition, they are instrumental in preserving possessions for kids from prior marital relationships, ensuring that their inheritance rights are supported in spite of any kind of subsequent marital unions. Additionally, prenuptial contracts can safeguard household presents or inheritances obtained throughout the marital relationship. Thus, the addition of a prenuptial arrangement in a marital relationship agreement can function as a protective shield, maintaining the honesty and security of family assets and rate of interests for future generations.

The Role of a Prenup in Clarifying Financial Obligations

Beyond protecting household properties, prenuptial agreements play a critical duty in defining financial duties within a marital relationship. In the regrettable occasion of separation, a prenup can protect against bitter wrangling over financial debts and possessions, as it clearly demarcates what belongs to whom. Hence, by clearing up monetary obligations, a prenuptial contract cultivates transparency and count on, two cornerstones of a strong marriage relationship.

Verdict

To link conclude, a prenuptial arrangement acts as a safety shield for individual possessions, organization rate of interests, and future inheritances before going into a marital relationship contract. It develops a transparent monetary you could try these out ambience, lowering potential problems and securing family members riches for future generations. It plays a crucial duty in defining monetary responsibilities, advertising healthy and balanced communication, and making sure security even when encountered with unforeseen circumstances.